SIP Calculator

Introduction:

Investing in mutual funds through a Systematic Investment Plan (SIP) has become increasingly popular among investors who want to build wealth over time. SIPs allow you to invest a fixed amount regularly, helping you take advantage of market fluctuations and the power of compounding. In this blog post, we’ll explore what SIP is, its benefits, and how you can use a SIP calculator to plan your investments.

What is SIP?

A Systematic Investment Plan (SIP) is a method of investing in mutual funds where you invest a fixed amount at regular intervals (monthly, quarterly, etc.). Instead of investing a lump sum, SIPs allow you to spread your investments over time, reducing the impact of market volatility.

Benefits of SIP:

- Rupee Cost Averaging: By investing a fixed amount regularly, you buy more units when prices are low and fewer units when prices are high, averaging out the cost of investment.

- Power of Compounding: SIPs allow you to benefit from compounding, where your returns generate additional earnings over time.

- Disciplined Investing: SIPs instill financial discipline by encouraging regular investments, regardless of market conditions.

- Flexibility: You can start with a small amount and increase your investment as your income grows.

How Does a SIP Calculator Work?

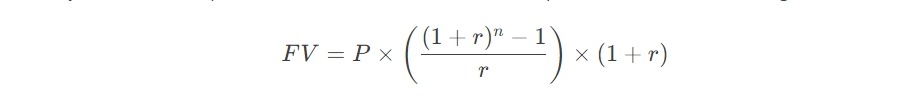

A SIP calculator is a tool that helps you estimate the future value of your investments based on your monthly investment, expected annual return, and investment period. It uses the following formula:

Where:

- FVFV = Future Value of the investment

- PP = Monthly Investment Amount

- rr = Monthly Rate of Return (Annual Rate / 12)

- nn = Total Number of Months (Investment Period in Years * 12)

Using the SIP Calculator:

- Monthly Investment: Enter the amount you plan to invest every month.

- Expected Annual Return: Input the expected rate of return on your investment.

- Investment Period: Specify the number of years you plan to stay invested.

The calculator will then display the future value of your investment, helping you make informed decisions about your financial goals.

Conclusion:

SIPs are an excellent way to build wealth over time, especially for those who prefer a disciplined and systematic approach to investing. By using a SIP calculator, you can plan your investments better and set realistic financial goals. Start your SIP journey today and take the first step towards achieving your financial dreams.